The creation of the Product Strategy is led by the question “What makes a successful product?”

The Product Strategy has three elements:

-

- Technical performance. How the product works

- Design. How the product looks

- Acceptance. The preference of customers

A successful product is one that customers prefer for its performance and design.

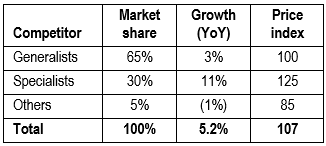

Imagine the home cleaning product market. There are two major groups of competitors: Generalists sell cleaning as well as other products; Specialists produce and sell only cleaning products.

What product is needed to win in a market like this?

The customers may help to find an answer, and we should begin by asking what is relevant for the Product Strategy: Performance and Design.

But it is not what some may think.

At the strategy level, performance is of two kinds only: Superior or Equal.

Therefore, in our example, we may test a product (be it a concept, a prototype, or the real product) in a specific usage condition (say, with warm and cold water) in order to confirm that users perceive its superior performance versus Generalists, and equal performance to Specialists.

Try LogRatio’s fully automated solution for the professional analysis of survey data.

In just a few clicks LogRatio transforms raw survey data into all the survey tables and charts you need,

including a verbal interpretation of the survey results.

It is worth giving LogRatio a try!

How do users judge the technical performance of products in this market?

This question can be answered by means of one or more marketing research projects like these:

-

- Usage & Attitude study (U&A). Usage of and attitude towards one or more products or concepts.

- Habit study. Measures customer behavior in order to find ways to influence it.

- Blind Product Test. Anonymous products compared on technical performance.

- Identified Product Test. Identified products compared on technical performance.

- Concept test. Validity of an idea, slogan, product concept, etc.

- Brand image test. Measures the image and tests any corrections compared to the ideal brand.

- A/B test. Measures the performance of two or more variations of the same message, concept, product, or else.

Which design is preferred by the product users?

Depending on the product type, this question can be answered with one or more studies like:

-

- Look & Handle test. Reaction to package handling and look.

- Sensation transfer study. Of a testimonial, packaging, selling idea, etc.

- Sniff test. Reaction to product smell.

- Taste test. Aims to find the most appealing balance of ingredients that satisfy the expectations of customers.

These surveys are conducted with real consumers.

The sample must be representative of the population it comes from, typically in the form of a random sample.

The sampling error must be low, in order to collect reliable information.

Find that mix of performance and design customers prefer and chances are that you have a potentially winning product.

Though this does not mean the product will succeed, as other factors also play a role in success.

Creating a product that could win the preference of customers is the pre-requisite for competing effectively in a market.

How to test the product packaging

The product packaging plays three roles:

-

- Promotional

- Informational

- Functional

Not all products use the packaging to promote and inform. It is however an important element of many branded products, especially those products that differ little from existing competitors.

As a promotional vehicle, the packaging aims to attract and retain the consumer’s attention through a design that stands out of the crowd of competing products, for instance when placed on the shelves of supermarkets.

Effective packaging can generate brand awareness, recognition, and a positive attitude in the mind of customers, and in so doing it increases the odds of a product being bought.

Shape, size, materials, and graphic design are all elements that can characterize a strong package, and their effectiveness can be measured, tested.

Broadly speaking, the packaging includes the product casing, like a bottle, sprayer, can, or other; and the product container, like a box or other sort of protective container. The shipping container works as an extension of the product container and some brands use it to communicate with professional customers, like shops, restaurants, etc.

Marketing research for packaging

Marketing research on packaging is a vast territory, and no one single test can cover it all. Brands betting heavily on branding and image should consider conducting a multifaceted research program tailored to evaluate relevant package components in coordination with other elements of the Copy Strategy.

Three main kinds of tests are often used in packaging research:

-

- Visibility and distinctiveness tests are used to assess the power of a package to stand out from the stifling presence of competing brands placed around it, for instance, on a cash counter, a dairy refrigerator, a freezer, etc. Two main metrics are registered: Visibility and memorization of the brand name. Any other brand-related memory is of course welcome. This kind of test can be conducted in a pure lab-setting and in simulated shopping environments, like the aisle of a supermarket. The size of the sample is usually small (up to 100 respondents), and it can be monadic or in comparison.

- Functional packaging tests measure the ease of handling, opening, resealing, and storing of a product package. This kind of test is mainly quantitative in nature, conducted in the form of face-to-face interviews or as an in-home use test. In other cases, the information is collected through focus groups, including the observation of the respondents during the test. Typically, small samples of potential users and buyers are recruited. Great attention must be paid to recruit respondents representative of real product category buyers and users.

- Feature preference test can comprise a very large number of features, which may make it quite complicated to measure the relevance of each product feature correctly both as a feature of the packaging and as an influencing factor of the customer’s perception of the whole product. For this reason, specialized research techniques, for instance Conjoint Analysis, are often employed to conduct feature preference tests.

How to test the branding decisions

Marketing research on branding elements is a complex, multifaceted endeavor. It should not be undertaken too lightly or be over-simplified.

A brand results from the combination of one or more elements aimed to identify the product and to distinguish it from competing products: name, payoff, symbols, and design.

Although nowadays most products are branded, there is a return to unbranded products, especially among distribution chains, which in a way could be understood as a new form of branding because most rely on the store brand.

Brand-names can take at least two forms:

-

- Product-specific, like Swiffer, Tide, or Pampers

- Hybrid, combining company name and product name, like Kellogg’s Corn Flakes, Heinz Ketchup

Strong brand names possess some peculiar characteristics:

-

- Linkage to the product benefit, like Amplifon, Gourmet pet food, Febreze, Antikal

- Recall product qualities, like Gran Cereale, Bio Sweet Corn, Old Spice

- Easy to pronounce and remember, like Oral-B, Wick, Olay

- Distinctiveness, like Google, Kodak, LogRatio

- Unambiguous, as certain words may have an undesired meaning in that or other languages. For instance:

- Hyundai Kona (Cona in Portuguese means vagina)

- Mitsubishi Pajero (Pajero in South America is a person who masturbates a lot)

- Chevrolet Nova (Nova in Spanish means doesn’t work)

- Whorepresents.com

- Penisland.com

- Teacherstalking.com

- Therapist.com

- Analtech

- And counting…

Try LogRatio’s fully automated solution for the professional analysis of survey data.

In just a few clicks LogRatio transforms raw survey data into all the survey tables and charts you need,

including a verbal interpretation of the survey results.

It is worth giving LogRatio a try!

Marketing research for branding

Marketing research for branding purposes follows two major phases:

-

- Generation of brand elements

- Evaluation of brand elements

Generation of brand elements

It must be noted that the generation of name, logo, symbol, payoff and design usually relies on the creativity of graphic designers and art directors. Brand names, however, can be generated with traditional methods of marketing research, like asking consumers and collecting expert opinions.

Consumer methods to the generation of brand names often are built upon the concept of association. Sentence completion and free associations have been employed with success to identify semantic associations. Focus groups have been used to generate brand names, while computer-based approaches screened by experts, other than the company management, are also quite common.

Evaluation of brand names

The selection of the dependent variable is the pivotal aspect of the evaluation of brand names with traditional marketing research methods.

The dependent variable determines the reaction the name should elicit in the customers.

Is it to favor the name recall? Or should it be associated with a certain quality/benefit of the product ( a Tide of suds)? Or the producer company (Heinz Ketchup)? Or should it disassociate the product from one or more competitors (Sprite, the non-cola)?

Defining the expected reaction of the customer will orientate the research program.

Less complex research designs rely on free association methods, rating and ranking of names based on the perceived level of association declared by the respondents between the name and the dependent variable.

More articulated research projects may resort to Conjoint Analysis for the analysis of multiple elements at once.

The data analysis approaches vary from cross tables to multidimensional scaling, cluster analysis, and other multivariate statistical technologies.