The Pricing Strategy defines the criteria to set a proper price.

It doesn’t set the price itself, because the price is an operating value and does not belong to a strategic document.

An example may help to explain the concept. The Pricing Strategy of an iconic brand most of us know reads:

The implication underlying this statement is that the economic value of a product is equal to the reference value (the price of the best alternative) plus the differentiation value (the value of what makes our product different from and more valuable than competing products).

Setting the reference value implies knowledge of the competitive landscape, the market. Sales Panel data and other information are often used to define the market of reference (all competitors) of a product. Then, direct competitors are isolated, and among them we choose the best alternative to our product (the reference value).

Direct competitors are products that:

-

- Operate in our same market,

- Offer a comparable technical performance to our product, and

- Talk to our same consumer group

And, consistently with the strategy example above, we select one or more competitors with comparable marketing investments.

When the competition of reference is selected, marketing research can help to measure the value of differentiation, aka value of superiority.

The value of superiority

The value of superiority is hardly measurable with a single value. Most often it is a construct, aka latent variable, and as such it is measured through the combined values of more than one variable. Other typical marketing constructs include customer satisfaction, brand loyalty, and brand equity, just to mention a few.

In other cases, often in the B2B field, the value of superiority can be computed by finding two values:

-

- Reference value is the price of the best alternative to our product

- Differentiation value is the value of the differentiating strength of our product. In other words, it is the value of the features that make our product different and more attractive to customers than competing offers

It must be said that a Price Test is also a common type of marketing research used to measure customer sensitivity to price changes. It is often used in combination with promotional activities, when experience values are not available. To define the Pricing Strategy, however, the Price Test isn’t a good fit because it is of an operating nature rather than strategic.

Try LogRatio’s fully automated solution for the professional analysis of survey data.

In just a few clicks LogRatio transforms raw survey data into all the survey tables and charts you need,

including a verbal interpretation of the survey results.

It is worth giving LogRatio a try!

How to compute the value of superiority

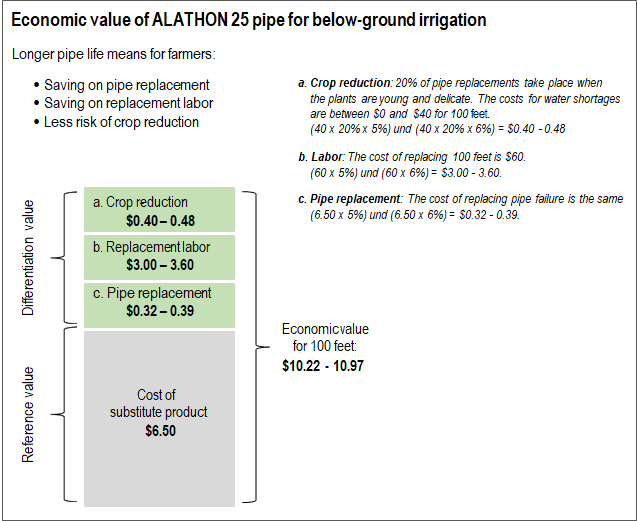

Nagle and Holden provide the example of Alathon 25, a polyethylene resin used for manufacturing flexible pipes with longer durability.

For a farmer with below-ground irrigation pipes, longer durability, hence the value of superiority or differentiation advantage of Alathon, means:

-

- Purchase of less replacement pipes

- Less frequent work to replace pipes

- Lower risk to damage the harvest due to water scarcity during pipe replacement

These three advantages can be translated into monetary values for the customer. Given these are exclusive features of Alathon not matched by competitors, their value goes on top of the reference value determined by the best alternative pipe to Alathon, and the overall sum returns the selling price.

Du Pont, the producer of Alathon, could estimate these values with a short descriptive survey of farmers.

A caveat

Profitability is commonly reached by means of lower costs (hence higher efficiency) or a higher price. Lower costs, however, don’t always fit with the need of offering a product with comparable technical performance to leading players in the market. In fact, superior performance typically requires higher production costs. Therefore, from a strategic perspective, a larger price is often the way to follow, which implies a strong enough performance to justify the higher price.

Sources

Thomas T. Nagle, Reed K. Holden, The strategies and tactics of pricing (2002). Prentice Hall.