Segmentation and differentiation are perhaps the most powerful weapons in the marketing arsenal. Yet they are also the least understood. Why? Because way too often marketers do not understand customers. They can talk products, but features don’t make products different. This article aims to shed some light on how to create solutions that are really desirable to buyers and users while being truly different from competing brands. Enjoy it.

In 1879 two candle makers from Ohio saw their sales struggling due to the introduction of a new competing product: oil lamps (sort of what happened to encyclopedias when Google was born).

In an attempt to recover the situation, the two company partners considered launching a new product: a soap bar. So they began researching the soap market.

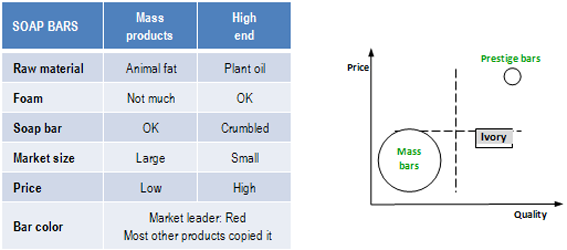

The research identified two major market segments:

-

- Mass soap bars. A large segment of cheap soap made out of animal fat that didn’t produce much foam

- High-end bars. A small segment of highly-priced soaps made of plant oil that produced foam, but the bars couldn’t hold together for long

Image 1: US bar soap market in 1879. Image 2: US bar soap market segments in 1879.

What would you have done?

What soap bar would you have launched that was different enough from existing competitors to win the preference of customers?

Wait! Before modifying the physical product think about user habits.

How did people bathe back then?

Understanding customer behavior

Back then, on Sunday morning one family member at a time bathed in the same bathtub. The father came first, then came the oldest son, and then all the other family members. After each bath some water was added. The water soon became murky, and trying to find the soap bar on the tub bottom was annoying.

Now, with this information available, what would you have done?

Exactly: floating soap! That soap bar was named IVORY and today, after almost 150 years, it is still going strong. By now you may have realized the company was Procter & Gamble.

Image 3: Ivory bar soap at launch time.

The birth of strategic marketing

P&G improved the soap bar and made Ivory really different and difficult to copy[1].

They used plant oil and created soap bars that made foam without crumbling. They priced it higher than cheap products but lower than high-end bars. Finally, they made it float; the real differentiating element that contributed to making Ivory the preferred bar of Americans for decades.

At the time Ivory was born there were already other brands that we also find on the shelf today. However, Ivory was the very first brand born out of what some 50 years later Neil McElroy formalized in his legendary memo “The duties and responsibilities of the brand man”[2], and the modern concept of strategic marketing was born. All marketers owe a huge thank you to P&G, and those marketers who have really understood and applied the laws of segmentation and differentiation should shout it even louder.

Image 4: Ivory bar soap today.

Marketing lessons learned

I’d like to share with you the four lessons I have learned from this story, with the hope that they will also help you in building enduring brands.

1. Solve real problems

The issue with Ivory wasn’t the price (it very seldom is). It wasn’t the fat, the package, the soap color, or anything else. The real issue was about understanding the consumer. And this is the problem many marketers still can’t solve today, hindering their chances of launching successful products.

Learn to understand customers and you will make a giant leap in understanding how to create successful brands. How? Learn how marketing research works. Unfortunately, doing a few research studies a year, if at all, isn’t enough.

Try LogRatio’s fully automated solution for the professional analysis of survey data.

In just a few clicks LogRatio transforms raw survey data into all the survey tables and charts you need,

including a verbal interpretation of the survey results.

It is worth giving LogRatio a try!

2. Launch really different solutions

When asked the question above – “What would you have done?” – an almost discouraging number of people said they would lower the price (by far the most cited solution), change the bar color, or solve the foam or crumbling issue. With any of these solutions you just end up with one more copycat with a different feature destined to fail.

I suggest that you bring your competitors’ products into the lab and test them at work, find their weaknesses (all products have at least one), and ask consumers if they agree. Then you can begin developing a superior solution which delivers a better customer experience. But bear in mind, that key characterizing element doesn’t necessarily have to be linked to the product technical performance. Soap is for cleaning, and the bar floating doesn’t contribute to the cleaning job, yet consumers welcomed it very warmly.

Invite development folks to help find the technical solution, while you engage your mind with the creative work to make the new solution really different. Is it difficult? Yes. Is it your job? Yes. So get out of the comfort zone and start earning your marketing title.

3. Split markets to create new segments

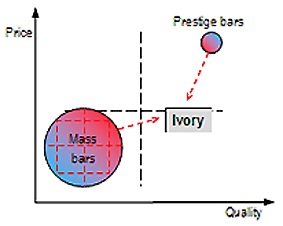

In an existing market crowded by ravening competitors, your best option to win is changing the rules of the game. This is what Ivory did. They shifted the purchase paradigm from cheap or high-end to affordable quality, subtracting shares of customers from both old segments.

This is a concept the Greeks spoke about some 2,400 years ago and the Romans summarized it as Divide et Impera (or Divide and Rule in English), and this is the trick to finding space in a market. Otherwise, your product will choke under competition pressure and ultimately fail.

To split markets it is important to understand their boundaries. Image 5 depicts (simplistically) the concept. The bubble colors range from blue (cold) to red (hot). Customers in the red zones may be attracted to new offers. Some buyers of mass soap in the red area may shift to new products of better quality for a moderately higher price. And some buyers of prestige soap may be appealed to buy more convenient products of slightly lower quality.

Image 5: How to split markets.

Bring these customers together and you create a new market segment. However, price and quality aren’t always enough to move customers away from their current preferences. The new product must be really different (Ivory floats).

4. Marketing research is your best ally

The Principles of P&G’s Statement of Purpose (SoP) include “We develop superior understanding of consumers and their needs”.

Read that statement carefully. They do not say a generic “We understand customers” or even worse “We know the needs of our clients”. P&G talks of a superior understanding, but superior to whom? To competitors of course, because P&G knows how important it is to make decisions based on sound data, and they are so convinced of it that they wrote it in their SoP, the highest strategic document inspiring each and every brand plan they create.

If P&G recognizes the value of survey research, you should too. And if you cannot see the value it is only because you do not know how to use surveys. Again, stop finding reasons to support your gut-driven approach to pseudo-strategic marketing. Leave your comfort zone and learn how to make strategic decisions appropriately.

Running surveys today is cheaper and faster than ever before. Learn how to make brand research plans, how to design surveys, and how to read research numbers. Your business will thank you. And don’t discuss your research with the agency Key Account Manager; you want to have the Researcher at your table. The learning process may take time but it’s worth the effort.

Try LogRatio’s fully automated solution for the professional analysis of survey data.

In just a few clicks LogRatio transforms raw survey data into all the survey tables and charts you need,

including a verbal interpretation of the survey results.

It is worth giving LogRatio a try!

Closing

Some 80 years after Ivory’s success, Lee Iacocca applied similar reasoning and launched a car poised to make history: the Ford Mustang. More recently, P&G reapplied the concept to Olay, creating the Masstige market segment (from Mass and Prestige) to dominate it and grow another billion-dollar brand.

Features don’t make products different.

You must make sense in the context, choose and understand customers, study competitors, and find a price-value balance for the chosen customers. Only then should you define the product to develop. First ask what is needed, and then create it. Way too often marketers work in reverse order and end up with copycat products that offer nothing more than another feature. Customers want more. They want really different solutions worth their money.

________________________________________

[1] It isn’t completely clear whether the floating happened by chance or not. This is however irrelevant. P&G recognized the commercial strength of the process and protected it, to create what today we would call a blockbuster.

[2] It must be acknowledged that other P&G’ers laid the ground that allowed Mr. McElroy to write the memo, like William Cooper Procter, Deupree, Rogan, Stockton, Buzby, and others.